BE ADVISED: Boston Partners does not conduct business over WhatsApp or other social media platforms. We are aware of a number of scams being perpetrated using the identities of investment advisers, including Boston Partners. Please invest carefully and contact us if you have any questions.

Valuation

Fundamentals

Momentum

Discover our unique approach to value investing

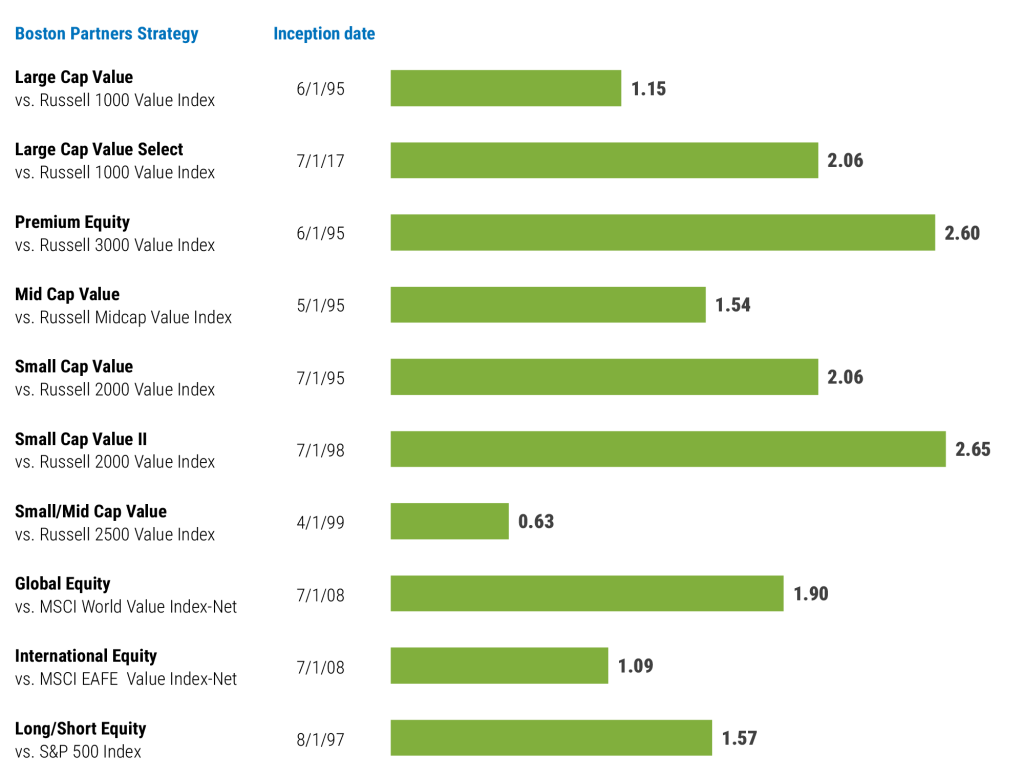

Since 1995, Boston Partners has been applying a single investment philosophy and process to every strategy we manage: We seek out attractively valued companies with strong fundamentals that are exhibiting positive business momentum. We call it our Three Circles approach, and we believe the results speak for themselves.

A single, time-tested process. A history of outperformance

Average annual excess return net of fees for select strategies since inception (%)

Data as of March 31, 2025. Source: Boston Partners. The green bars reflect the average annual excess return (net of fees) versus the indexes shown since each strategy’s inception. Past performance does not guarantee future results. It is not possible to invest directly in an index.

Explore our institutional strategies

Our flagship U.S. equity strategy targeting attractively valued large cap-companies.

An established value-oriented strategy targeting midsized U.S. companies.

A strategy seeking attractively priced opportunities outside the United States.

Designed to offer compelling returns with less market risk, this strategy combines long and short positions in U.S. equities.